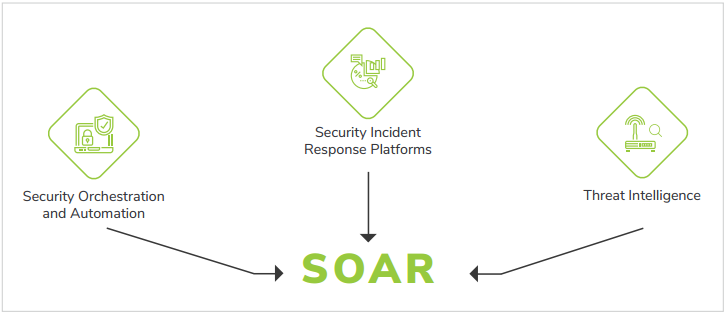

The global market for Security Orchestration, Automation, and Response (SOAR) is a theater of intense and highly strategic competition, where technology vendors are battling to become the central automation and workflow engine for the modern Security Operations Center (SOC). A close examination of the Security Orchestration Automation and Response Market Competition reveals that the rivalry has evolved from a battle between a few pure-play startups to a major strategic confrontation between the world's largest cybersecurity and cloud platform companies. The competition is fierce because SOAR is a critically "sticky" technology; once an organization has built its incident response processes and automated playbooks on a specific SOAR platform, the cost and complexity of switching to a new one are immense. The Security Orchestration Automation and Response Market size is projected to grow USD 8.27 Billion by 2035, exhibiting a CAGR of 10.52% during the forecast period 2025-2035. This sustained growth ensures that the competition will remain intense, as the major platforms vie to make their SOAR offering the indispensable core of their customers' security operations.

The central competitive dynamic has shifted from a market of independent, best-of-breed SOAR platforms to a market dominated by SOAR as an integrated feature of a broader SecOps platform. The primary competition is now between the major SIEM (Security Information and Event Management) and XDR (Extended Detection and Response) platform vendors, who have all either acquired or built their own SOAR capabilities. The competition between Splunk (with Phantom), Palo Alto Networks (with Cortex XSOAR), and Google (with Siemplify integrated into Chronicle) is a prime example. These players are no longer selling a standalone SOAR tool; they are selling a unified Security Operations platform that combines log management, threat detection, and automated response. Their competitive advantage is the promise of a single, integrated platform with a seamless workflow, where an alert generated in the SIEM can automatically trigger an automated response playbook in the SOAR module. This "platformization" of SOAR is the defining competitive trend, putting immense pressure on the few remaining independent SOAR vendors.

This primary platform rivalry is further complicated by the massive competitive presence of Microsoft. Microsoft's strategy with its Sentinel platform is to offer powerful, native SOAR capabilities as a core, integrated component of its broader cloud security ecosystem. For the growing number of enterprises standardizing on Microsoft for their security, Sentinel's built-in SOAR is a highly compelling and cost-effective option that is deeply integrated with the rest of the Microsoft security stack. This creates a powerful competitive threat to all other vendors. Another key competitive battleground is the breadth and quality of the integrations, or "connectors," that a SOAR platform offers. A SOAR platform's value is directly proportional to its ability to connect to and orchestrate a company's entire security stack, which may include dozens of tools from different vendors. The vendors are in a constant race to build and maintain the largest library of pre-built, reliable integrations, as this is a critical factor in a customer's purchasing decision. The competition is a battle to be the most open and connected "conductor" of the security orchestra.

Top Trending Reports -

Germany Photogrammetry Software Market