The branded generics market is experiencing sustained expansion as healthcare systems worldwide strive to balance cost containment with access to trusted, quality-assured medicines.

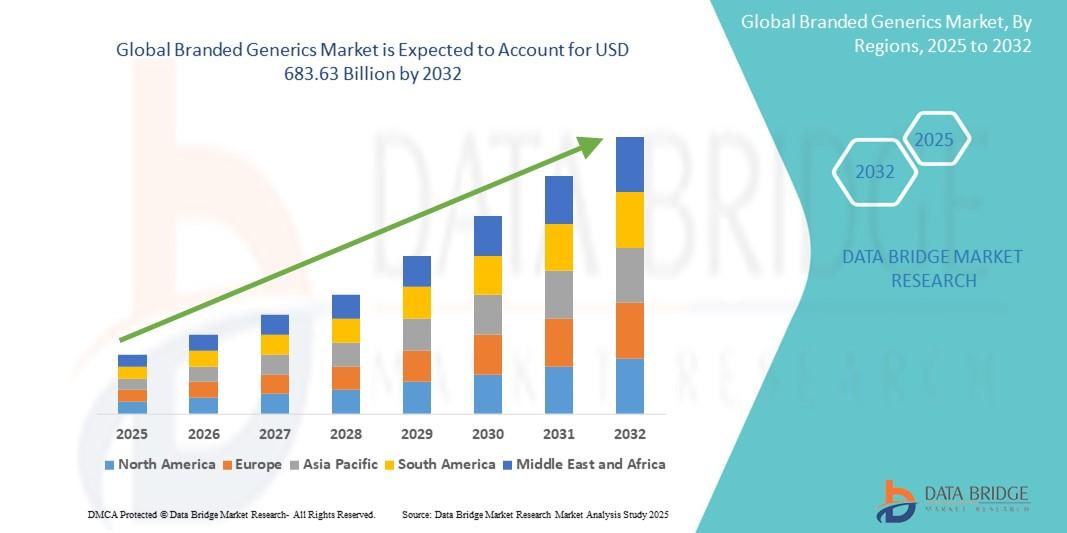

The global branded generics market size was valued at USD 368.52 billion in 2024 and is expected to reach USD 683.63 billion by 2032, at a CAGR of 8.03% during the forecast period

Branded generics—products that combine the affordability of generics with brand recognition—are increasingly preferred by payers, hospitals, and physicians who want cost-effective therapies without sacrificing perceived quality. This report examines market size dynamics, segment-level drivers, emerging trends, competitive forces, and the forecast outlook for the branded generics sector.

Market Overview

Branded generics occupy a unique niche: they are off-patent molecules marketed under a brand name and often supported by local marketing, patient support programs, and enhanced distribution. In many emerging and developed markets, branded generics contribute significantly to pharmaceutical revenues owing to strong prescriber loyalty and widespread adoption in private and public procurement channels. Growth in this market stems from rising chronic disease prevalence, expanding healthcare coverage, and pricing pressures that favor lower-cost but trusted alternatives.

Market Size & Share Insights

The branded generics market size reflects a combination of unit growth and value migration from originator brands to lower-priced branded options. Regions with substantial generic penetration—such as India, Latin America, parts of Asia-Pacific, and select European markets—show robust market share for branded generics due to strong local manufacturing bases, established distribution networks, and active physician prescribing habits. Increasing tendering by governments and bulk procurement programs are also influencing value distribution across segments.

Key Growth Drivers

-

Cost containment pressures: Healthcare payers and governments favor affordable therapeutic options that lower overall treatment costs while maintaining treatment adherence.

-

Local manufacturing capabilities: Strong pharmaceutical manufacturing ecosystems reduce production costs and support scale-up of branded generics.

-

Physician and patient trust: Branded packaging, marketing support, and perceived quality help branded generics retain pricing power and loyalty.

-

Rising chronic disease burden: Growth in conditions like diabetes, cardiovascular disease, and respiratory illnesses expands demand for long-term, affordable medicines.

-

Improved distribution & access: Expanding retail pharmacy networks and e-pharmacies enhance reach into semi-urban and rural markets.

Segment Analysis

By Therapeutic Area

-

Cardiovascular

-

Anti-diabetic

-

Anti-infective

-

Central Nervous System (CNS)

-

Respiratory

-

Gastrointestinal

Cardiovascular and anti-diabetic segments often lead in volume due to the chronic nature of treatment.

By Dosage Form

-

Solid oral (tablets, capsules)

-

Injectables

-

Topicals

-

Others

Oral solids dominate owing to manufacturing simplicity and cost advantages.

By Distribution Channel

-

Retail pharmacies

-

Hospital pharmacies

-

Online pharmacies

Retail and hospital procurement remain critical, but online channels are accelerating reach and convenience.

By Region

-

Asia-Pacific (notably India and China)

-

Latin America

-

Europe

-

North America

-

Middle East & Africa

Asia-Pacific and Latin America typically show the highest growth rates because of expanding healthcare access and strong generic ecosystems.

Emerging Trends

-

Value-added services: Manufacturers bundle patient adherence programs, nurse support, and digital adherence tools to differentiate branded generics.

-

Biosimilar branded generics: As biologics lose exclusivity, some manufacturers launch branded biosimilars with localized support services.

-

Strategic M&A and licensing: Regional players pursue acquisitions to broaden portfolios and gain market access rapidly.

-

Regulatory harmonization: Streamlined approval pathways and quality standard convergence are enabling faster market entry for branded generics.

-

Private label & retailer partnerships: Pharmacies and retail chains increasingly collaborate with manufacturers on exclusive branded generic SKUs.

Challenges & Restraints

-

Pricing pressure and reimbursement changes can compress margins.

-

Quality perception gaps in some markets require continuous investment in manufacturing standards and pharmacovigilance.

-

Regulatory hurdles—including local clinical requirements and varying bioequivalence standards—may delay launches.

-

Competition from true generics and originator discounts requires careful portfolio positioning.

Competitive Landscape

Leading participants range from large global generic houses to nimble regional specialists. Key strategies include:

-

Expanding therapeutic portfolios via in-licensing and acquisition.

-

Investing in branding, physician engagement, and patient support to retain premium positioning.

-

Enhancing supply chain resilience and local manufacturing to reduce lead times and costs.

Partnerships with hospitals, governments, and retail chains are common to secure long-term tenders and gain formulary access.

Forecast & Outlook (Short to Medium Term)

Over the forecast horizon, the branded generics market is expected to maintain steady growth driven by demographic trends, healthcare access expansion, and sustained demand for affordable medicine. The fastest growth will likely be seen in markets with supportive generic policies, growing middle classes, and investments in primary care infrastructure. Product differentiation through services, digital adherence tools, and targeted therapeutic focus will determine which players capture the most value as competition intensifies.

Browse More Reports:

Global Hybrid Imaging Market

Global Indirect Debris Removal Market

Global Integrated Labelling System Market

Global Low Emission Vehicles Market

Global Metal Carboxylate Market

Global Microcontroller for Parking Assist System Market

Global Micro-Perforated Food Packaging Market

Global Mortuary Equipment Market

Global Non-volatile Memory Express Market

Global Obesity Treatment Market

Global Ophthalmic Packaging Market

Global Organic Asphalt Modifiers Market

Global Printed Tape Market

Global Propionic Acid for Animal Feed Market

Global Rear Electric Axle (E-Axle) Market

Conclusion

The branded generics market offers a compelling combination of volume opportunity and brand-driven value. Manufacturers that balance cost-efficient production with service-led differentiation, robust quality assurance, and targeted market access strategies will be best positioned to capture growth. As health systems focus on sustainable spending and wider access, branded generics will remain a pivotal segment in global pharmaceutical portfolios.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com